The Pakistani rupee has been continuously depreciating, as the US Dollar reaches all-time high rates. The value of USD touched 153.50 in the open market on Tuesday with the rupee falling 1.5 compared to the preceding exchange rate. Over the week, the depreciation rate of more than 5% has been observed.

The State Bank of Pakistan, which lifted interest rates by 150 basis points on Monday to 12.25%, said it was watching the foreign exchange market closely and would act in the case of “unwarranted” volatility. The inflationary pump is expected to continue for some time, but the Bank is closely monitoring the situation and will respond in time when needed, added the Bank.

The overall depreciation of rupee since the start of this fiscal year is over 21%. The decline has acted adversely on the consumer, as prices of general commodities have raised significantly. Trading business is also highly affected by frequent fluctuations in the rates.

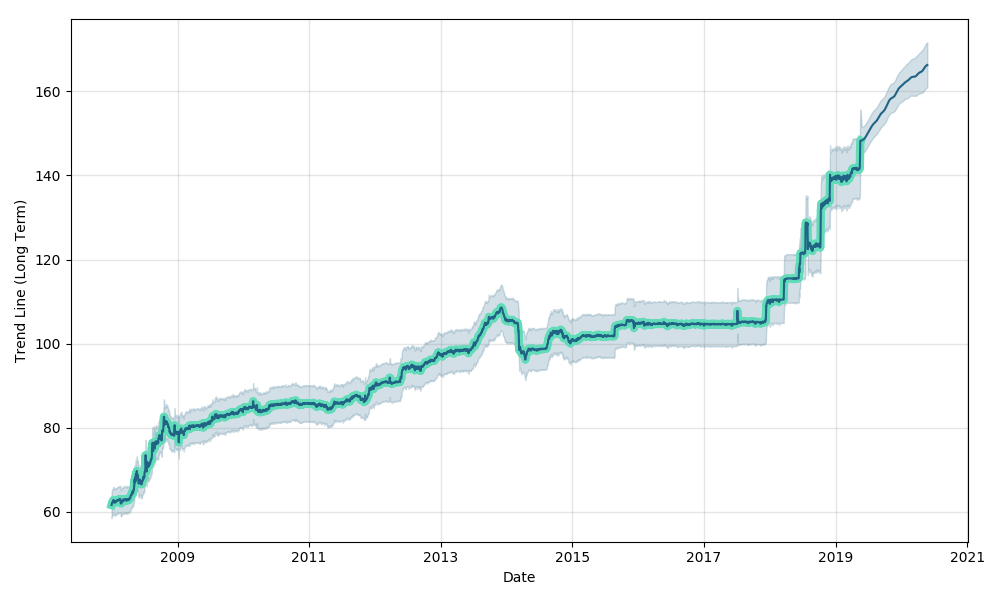

With the current growth rate of USD, the speculated exchange rate of 160 to 170 does not seem much far. In a hopeless situation, the Islamic aspect was introduced today. Fatwa against the hoarding of USD to sell it out on higher rates was announced by the renowned Muftis.

Another drawback of the increasing USD is that it drastically raises international debts. As announced today, the total debt of Pakistan has reached Rs.35 trillion, almost equal to the total size of the economy. In the given conditions, the government needs to sort out the bottlenecks and come up with better planning, before it is too late.

According to Wallet Investor Forecast, Dollar will touch 170 mark by the year 2020 – 21

Leave a Reply