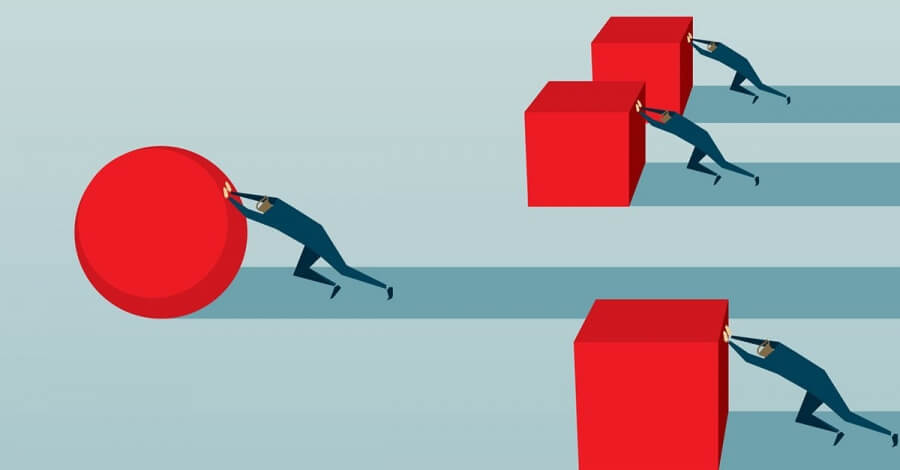

Traders enter the Forex market with an aim to earn profit. Some end up earning profit, while a few abstain from trading, due to consistent losses.

Common Forex trading mistakes to avoid

Lack of education

Every successful trader will advice you that committed Forex trade learning is very vital. Actually, traders forget that they are getting trapped in a career that takes years to become a pro. Novice traders hardly know where to start.

For a start read about trading from different resources, attend seminar, watch webinars, and practice a lot of trading on demo accounts. Vortex Assets is online trading platform, which provides traders with necessary education resources and demo account for practice.

Skip on trading plan

Having a plan for any kind of project is good to obtain positive results. In Forex market, traders make an inexcusable error of not creating a trading plan. The possible reason may be lack of knowledge about creating a trading plan. Educational resources on Vortex Assets can help you with sketching a trading plan

Basically, a trading plan includes a set of rules created on the basis of his trading style and bank management strategy. It needs to be adhered to strictly. In short, a trading plan is a list of don’ts and do’s like –

- When to enter a trade

- Amount of cash you can risk

- When to put a stop loss order

- When to take the profit

- Set a time, when market reaches your target

While trading, this trading plan needs to be placed in front, so that you always remember to follow it. Yes, at times trading plans need to be adjusted, so be open for changes also.

Ignoring bank management

Vortex Assets give plenty of autonomy in terms of leverages, so things may get chaotic, very fast for traders. Beginners may dawdle in bank management discipline. This can lead to high risk trading but with a trading strategy in place the odds can be mitigated or eliminated.

Unrealistic expectations

Forex market does not move as per our desires. Traders need to accept that trade market can be irrational. For example, it can turn volatile, choppy, and trendy in long, short, or mid-term cycles.

Trading plan allows averting unrealistic expectations. Remember, with Forex leverage a small increase can turn large.

Trading after news headline

Market starts moving aggressively, as soon as news headline gets announced. Traders feel the moment is right to grab some pips. However, if this gets done without a solid trading plan then the results can be devastating. Actually, a trade in money turns rapidly bringing huge losses because large back and fro swings occur. Stops depend on liquidity, which may be not there. It means potential losses can be more than calculated.

Traders get ensnared in the above trading mistakes. They need to avoid them at any cost and develop a different approach. Have a pre-planned entry and exit strategy. Watch news until market volatility subsides, before hopping on board. Manage their expectations and accept what Forex market has to offer. Learn and understand the pitfalls and take steps to avoid them. This can make them find success in their trade transactions.

Leave a Reply