Transportation is by no means a small expense for the average citizen and most of us have already gone through the conversation of whether we need to purchase a car or not. Can we commute via public transportation? Is our office close to enough to walk or bike? Assuming that the agreed upon consensus is that a car is the correct choice, the purpose of this article will walk through various steps and questions to help make the utmost informed decision.

Should I buy used or new?

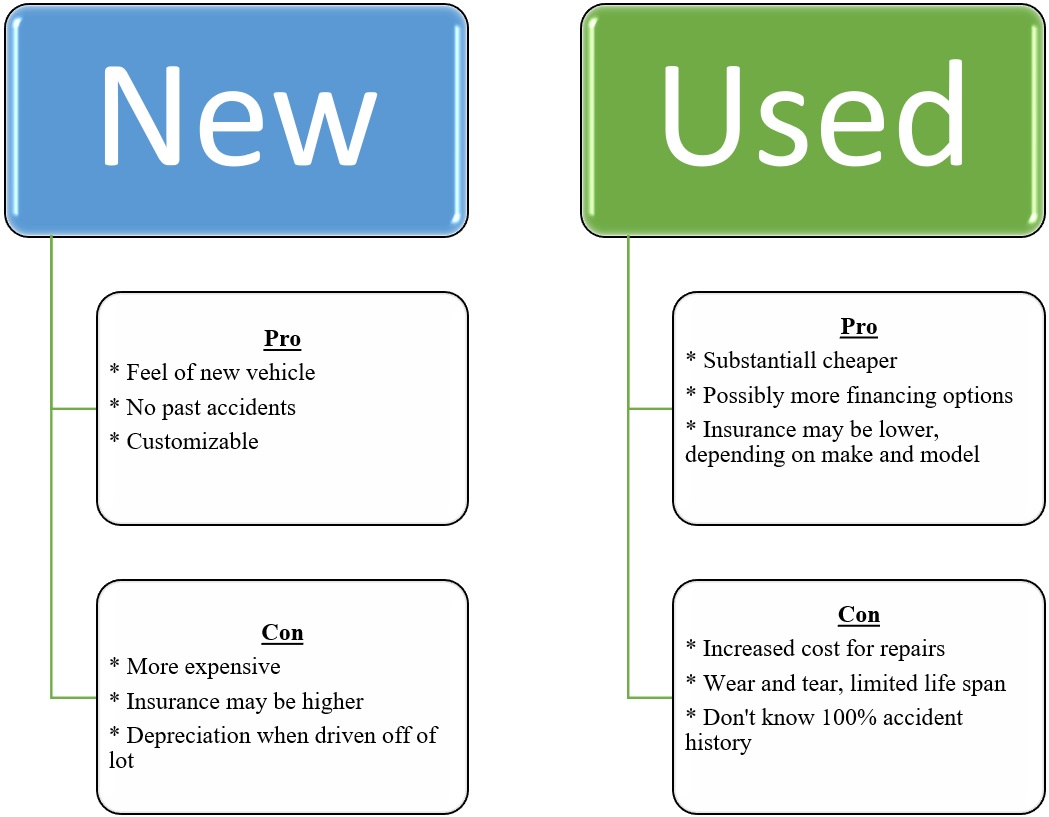

The first question you need to ask yourself is should you buy a new or used car. With each of these choices, there are both pros and cons on each side of the coin. Situations and preference will always be different for individuals so consider the following table outlining the benefits and downsides of each choice.

Should I finance or lease?

The average cost of a car is roughly $30,000 which is by no means a small amount of cash. As such, car dealers do not expect individuals to walk in with wads of bills to purchase a car in full. Instead, there are primarily two options to elect when acquiring your car.

The first option, financing, is when you decide to buy the car with the goal of owning it at the end of your term. A portion of all payments that are made are applied towards equity of your vehicle, and upon the successful repayment of your loan, the car now belongs to you. In addition to the ownership that you have now attained of your vehicle, you are not limited by allowed kilometers nor are you responsible to pay for damages such as scratches, as you are not returning the car to a dealership.

The second option, leasing, is when you retain your car for a set term, such as 4 years, where your monthly payments are going towards the “rental” of your vehicle. Upon the completion of your term, you are required to return the vehicle to the dealer and are left with zero equity or ownership in the vehicle. In addition, you are limited in the amount of kilometer allowance per year, typically ranging from 20,000 to 24,000 with an average cost of 8 to 20 cents per additional kilometer driven. In this scenario, if you were to drive an extra 2,000 km at a cost of 8 cents/km, this would cost you an extra $160.00.

Prior to deciding on whether or not you are going to lease or finance, there are a few questions you need to ask yourself:

- Do I prefer a new vehicle every number of years or am I ok with driving the same one for (hopefully) a long period of time?

- If I expect to drive a long distance of kilometers, even though I may prefer the luxury of a new vehicle every few years, how much will it cost me to drive this extra distance?

- Do I understand that with a lease, I am responsible to ensure the vehicle is not bumped up upon returning it, whereas with a finance I can choose to repair or not?

While many people place a strong emphasis on monthly payment affordability, there are many variables that need to be taken into consideration prior to making a final decision.

What expenses are there that I need to account for?

In addition to the monthly payments for your vehicle, whether leasing or financing, there are other expenses that need to be considered before purchasing your vehicle.

- Insurance – not all cars have the same insurance rates. Depending on the make and model (as well as your age, gender, location, etc.) insurance rates can have a wide range of prices. For example, according to the insurance hot line in 2019, the cheapest auto insurance vehicle is the Volkswagon Golf, followed by the Volkswagon Jetta and then the Chevrolet Cruze.

- Gas – Oil prices continue to fluctuate daily, currently standing at roughly 117.0 cents/litre. Gas prices today are not what they used to be in the past, nor will they remain like this in the future, especially as carbon taxes increase. Furthermore, some cars are better than others on their gas mileage, with larger vehicles using more gas per kilometer. If possible, consider purchasing a smaller vehicle so you can save money on your gas expenses.

Emergency!

Unfortunately, accidents are not uncommon anymore. According to the Canadian Transportation Safety Board, it is estimated that there are 160,000 car accidents that occur each year in Canada and that 2,800 to 2,900 result in death. Statistically, 22.7% of all car accidents occurred because of one car hitting the other. In 2012, of the crash deaths that did occur, 58.8% of drivers were under the influence of alcohol or drugs. These numbers are quite alarming and illustrate the reality that accidents do occur, unfortunately. These accidents come at a high expense as well, with car repairs ranging from hundreds to thousands of dollars. If you are in need of emergency cash, Magical Credit Inc. has a proven track record of providing quick cash to help you in dire situations.

Leave a Reply