The real estate market is in constant fluctuation and Australia is no different. After a slight decrease in trade in recent years, there are strong indications that the market is recovering. However, a lot of time still has to pass before the prices bottom out. Before this happens, future homeowners can expect lower home loans. Actually, they are at a historic minimum right now and this should be taken advantage of. The banking system does not operate in a vacuum so it was the falling unemployment rate and the slow but steady economic growth that caused the real estate market to bounce back.

Sydney and the rest of the country

Sydney, the economic powerhouse of Australia, had been a leader in this trend. Prices have hit a three-decade minimum. Not only that, but this fall is constant. Compared to last September, the prices have fallen by 12.8%, which is the biggest annual drop since 2010. The situation is not much different in other cities. In Melbourne, Adelaide, Perth, and Brisbane, prices have been dropping every month by an average of 0.5%.

Housing finances

Not only have housing prices dropped, but housing finance as well has seen a decline during a previous couple of months. They have reached their peak of 10.2% in July this year, but after that, they have spiralled down and are currently around -4%. The predictions are that by March 2019, the prices will have dropped by an additional 8% percent, nearing the projected historic minimum of -23% in March 2009. This drop was mainly caused by investors who had previously left the market.

An increase in home loans

A good indicator of the market is the size of the average home loan. In New South Wales the average loan back in 2010 was around 350.000 dollars. Nearly a decade later, this amount has increased by 100.000 dollars. Although the national economy is growing, data on home loans shows that the wages have not increased enough. That is why it is getting ever harder to get a housing loan despite the favourable interest rates.

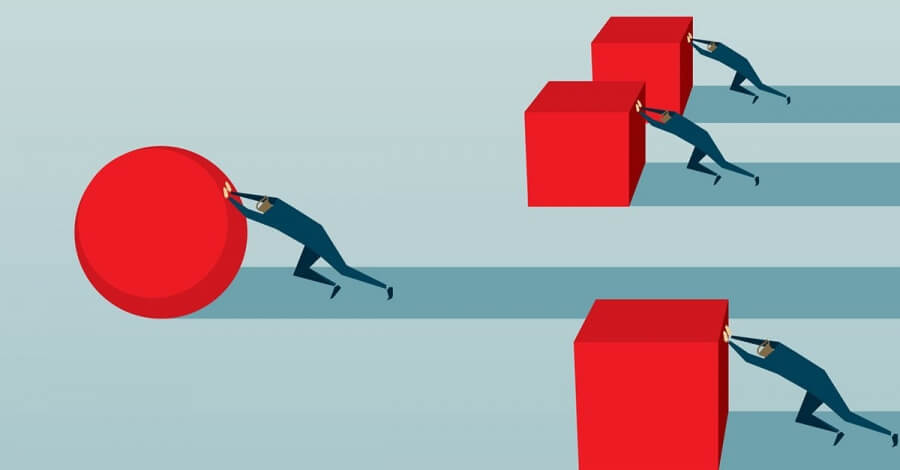

How to make use of the favourable market conditions

If you are thinking of buying your dream home right now, the conditions are definitely favourable. However, you still need the help of property advisors, such as Sydney’s Curtis buyers agents, who know the market better than anyone else. They follow all the trends and like brokers know where and when to invest. In reality, a property investment should be as stress-free as possible, so conferring with real estate agents helps you make a sound investment without much hassle. Such property consultations are usually free, so why not use them to your benefit.

Where to invest

We have already mentioned that statistics vary from city to city and from region to region. In terms of suburbs, the most desirable ones are not located in Sydney as you might think at first. Tasmania’s South Hobart and Battery Point are the top two suburban housing areas right now. This should not come as a surprise if we know that the drop in prices in Tasmania is just one percent lower than the one in New South Wales. Also, the median price in Hobart is the lowest in the country at just 417.000 dollars, despite a yearly growth of 4%.

The political climate

The politics in Australia cannot influence the housing market in a radical way, but politicians can still cause slight drops of prices. Unlike the presently volatile UK and US politics that are influencing the local markets, back in Australia things are much calmer. Radical right-wing parties have not unsettled the state, which is good for the housing market. Such political torpidity has facilitated the drop in prices, making it a bit easier to become a homeowner instead of a renter.

Finally, you shouldn’t jump into property investment just like that. Yes, the market is currently stable and more inclined towards home buyers than sellers, but things could change in the future. That is why it is always best to get some advice from property advisors because this is not the first drop in prices they have experiences in their respective careers.

Leave a Reply