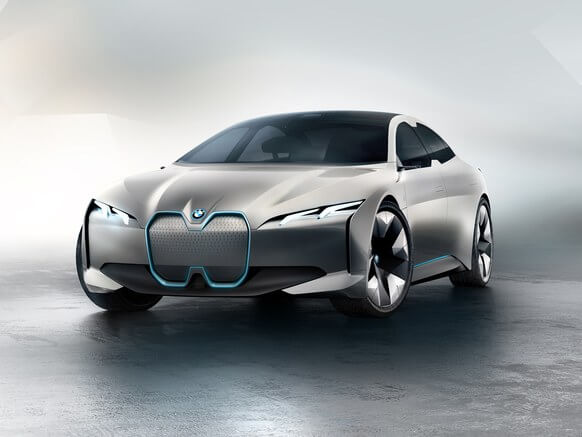

Do you have plans of investing in a car in the near future?

If you want to get the best possible financing deal on your car, it is important to ask the right kind of questions… and lots of them! Here are just 6 of the ‘must-ask’ questions to keep in your mind before you get to the dealers. Make sure you get truthful answers to these questions from them, so you don’t get ripped off. Only make a deal if and when you fully understand what you hear:

1. What interest rate will I be paying?

The only acceptable answer to this question has to do with the Annual Percentage Rate, i.e., APR.

It is, in fact, the best way to figure out what interest rate you will pay. The figure is the actual interest rate to be paid annually on the unpaid balance of the car loan. The percentage differs from one buyer to the other because it is based on the credit score of the buyer. The dealers can quickly get your credit score from your credit report.

2. What could be the possible penalties accompanying my loan?

Sometimes, it just so happens that the dealer ‘forgets’ to tell you about the potential problems that come with a car loan. So, it’s a good idea to clearly ask if paying off the loan early can result in a penalty payment. Also, find out if you would be liable for any additional charges during the term of the loan. Make sure you understand all the charges of the ‘hidden’ nature before signing the loan papers.

3. What can I do with the previous car?

Whether you are trading in the old car or selling it outright, its value is decided by the market.

If it’s a trade-in, we suggest that you first settle what you’ll be paying for the new car, and then discuss the trade-in price. The dealer might offer you a reasonable price and get the money he lost on car financing back from you. So, make sure you use the maximum value of this deal and get the right price for your old car.

Also, make sure that the money from the trade-in is applied towards the financing of your new car, because otherwise there is no guaranteeing that this amount will be used to lower the consequent payments for the new car.

The fact of the matter is that you will get more value for your old car when you sell it privately in the market. But it also translates into putting yourself into a bigger hassle. So, do your research, put an advertisement in the local classified, maybe even put it up on Craig’s List. And shop around for the best deal.

4. How much will this car cost?

When getting in Auto loans Houston, make sure you do your research. Here’s a surprise: paying sticker price for the car isn’t always the deal. You can bargain for a vehicle, and haggle the price of a car down.

Car dealers have a profit margin of 10 to 20 percent on each car, and it is possible to drive down their profit if the dealer is willing. So, research your new car, whether it is new or used. Find out it’s MSRP and drives down the invoice price based on that. You can find pricing information online as well; visit portals like Edmunds and Kelley Blue Book.

5. What if I don’t like the car?

Before you finalize the car, ensure that you really like and would want to keep it. Know that it takes a dealer with a heart of gold to bring back a car they’ve already sold! And to be on the safe side, find out if there is a return policy in place in case you change your mind. Get the salesperson to answer you. Get it in writing before you hand them the down payment.

6. Can I have credit insurance?

Your lender might require you to get credit insurance. They may even sell you to it. However, before you jump on the bandwagon, find out what it will cost you overall. Remember, you are not required by federal law to get credit insurance, but state laws may vary. And if you must pay, make sure it is reflected in the cost of credit, as well as the APR you’ll pay.

Leave a Reply