CIBIL score is the credit score has got its name from – CIBIL which is among the top 4 credit providing companies. The score is the numeric representation of the payment history based on which a person is approved for credit facilities such as credit cards and loans.

You must have heard people talking about their CIBIL score and thought that why the hell is everyone so interested in it? What is its impact on your life (financial) – good or bad? What if it’s good or bad? If it’s bad, can you change it? How would you know your CIBIL score?

In this article, we will cover each of the above-mentioned queries among others to understand and make you understand the real functioning as well as the importance of CIBIL score.

Why do people care about CIBIL Score?

CIBIL scores are very important when it comes to taking loans or any other type of credit facility such as credit cards. When you apply for any kind of loan product, the first thing lenders do is check your CIBIL report to determine your credit-worthiness. If your CIBIL score is high, the odds of getting approval for the product are strong, if other factors work in your favor too.

You can also bargain on some fees or charges if the lender finds other factors such as income and professional stability suitable. But if your CIBIL score is low, your other eligibility norms must be adequate enough for the lender to grant you the approval.

What is the impact of good CIBIL Score?

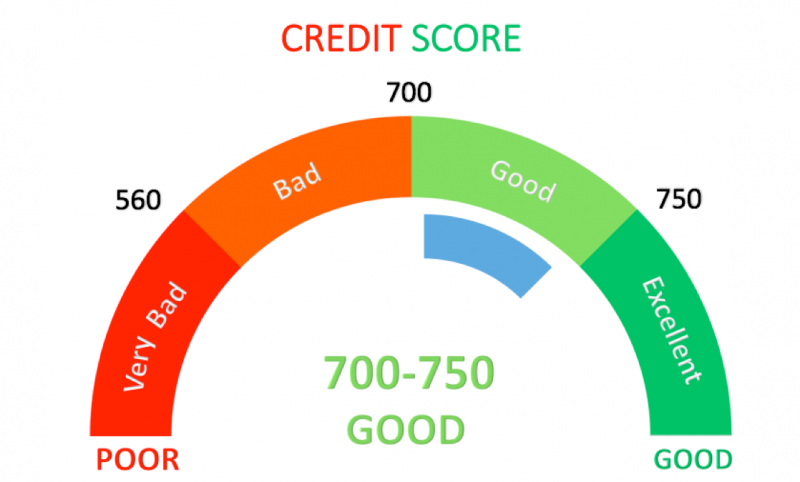

If a person has a good CIBIL score that is above 750, he or she is eligible for the list of options. The person gets the following benefits:

- A lower rate on loans and credit cards

- Eligibility for best credit cards

- Negotiation power on fees and charges

- Smoother approval for a credit card or loan

- Suitability for a higher credit limit on credit cards

- Higher loan amount

What is the impact of bad CIBIL Score?

As you can see above, a good CIBIL score fetches so many benefits which of course is not within the reach of those having a lower CIBIL or credit score. The list of disadvantages are here:

- Not eligible for best credit cards

- Not suitable for a lower rate on loans

- Not fit for a higher credit limit on a credit card

- Late approval for a loan or even get rejected

Can You Change Your CIBIL Score?

Where there is a will, there’s a way. Similarly, if you want to improve your credit score, you can follow some simple yet effective measures. Look at them below:

- Pay on time

- Do not go with the flow

- Spend within the Credit Limit (half)

- Apply for a credit facility

- Check Your Credit Report

- Set-up Payment Reminders

- Clear Debts as soon as possible

- Running away won’t help

How Can You Check Your CIBIL Score?

You can now check your CIBIL score online with PAN card. The steps involved in the procedure are as follows:

- Provide your full name as mentioned on the PAN card

- Enter your Date of Birth

- Choose the gender you belong to

- Mention your PAN card number

- Enter your contact address

- Provide the email ID fn which you want to get the credit report

- Enter your mobile number

- Submit the form

What is CIBIL Report and How Can You Get It?

CIBIL report is a single unified document that contains the credit history across different lenders over a significant period of time. It is a comprehensive report that provides the details of an individual’s or corporate entity’s borrowing history and repayment record. The CIBIL report includes the following information:

- Personal details of an applicant (name, age, gender and address)

- Employment details and earnings

- Number of hard inquiries made by potential lenders on receipt of the loan/credit card application

- Record of previous and current loans along with the payment record

- Any defaults on a loan

- The details of settled loans, if any

- Total credit limit and the amount spent monthly (Credit Utilisation Ratio)

- Any credit card payment defaults

- Credit score

With the above information, we hope that you have understood the importance and usage or credit score in your life. So, feel free to experience a very new journey and enjoy all added benefits.

Leave a Reply